Chancellor Rachel Reeves has acknowledged that recent tax hikes in her Budget may dampen pay rises for private sector workers, as businesses will either need to absorb these costs or pass them on to employees. The decision to raise National Insurance contributions (NIC) for employers, adding £25.7 billion in taxes, could push companies to curb wage growth, contradicting Labour’s promise to protect working families’ financial wellbeing.

Ms. Reeves admitted on BBC Breakfast that these tax increases “will have consequences.” She explained that businesses might face tighter profit margins and that “wage increases might be slightly less than they otherwise would have been.” This admission comes as economic experts criticize the tax as a “tax on working people” likely to reduce real wages. The Office for Budget Responsibility (OBR) further estimates that by 2026-27, approximately 76% of the total NIC increase cost will impact real wages through limited pay rises and inflation.

Ms. Reeves defended the tough budgetary choices, citing the urgent need to address a £22 billion deficit in public finances. She said on Radio 4’s Today programme: “This was necessary to get our public finances and services on a stable trajectory.” She later assured that smaller businesses would see protections against the tax hike, maintaining that Labour’s pledge to protect ordinary workers was not abandoned.

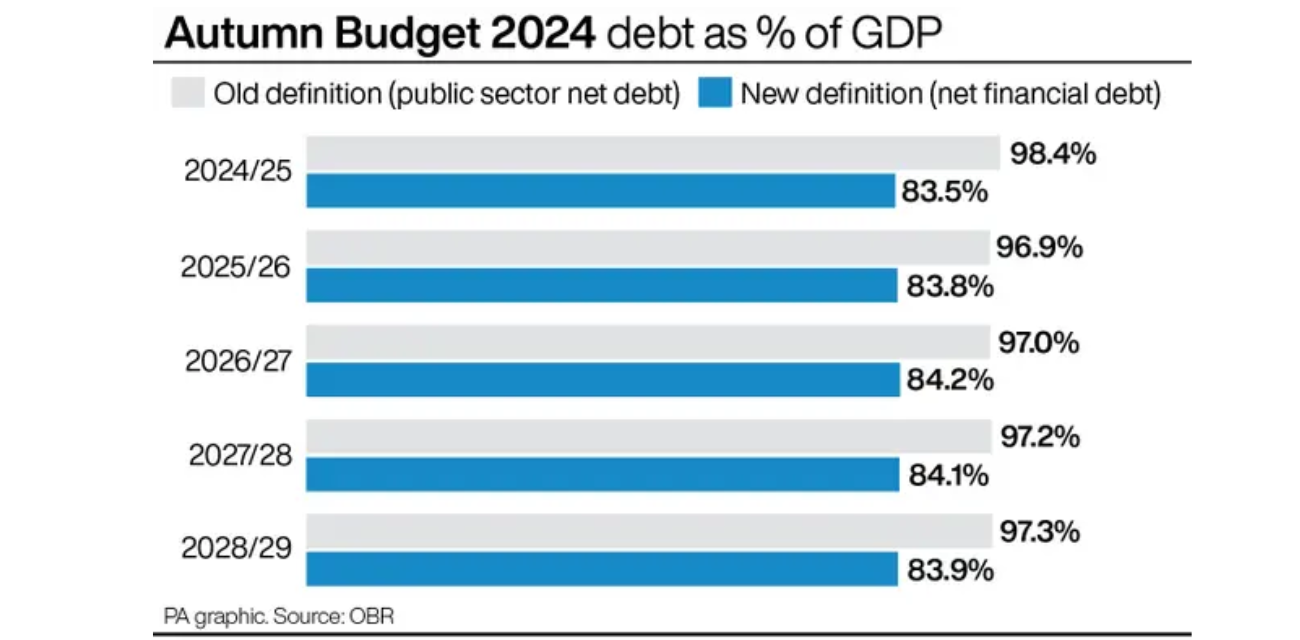

However, critics argue that the tax measures, which will raise the overall tax burden to 38.3% of GDP by 2027-28—the highest since 1948—contradict Labour’s platform. Shadow Chancellor Jeremy Hunt expressed disappointment, claiming that Labour’s manifesto had suggested a “new Labour prospectus, not a traditional tax-and-spend one,” leaving many voters surprised by the scale of tax rises.

Jeremy Hunt also warned that rising taxes will mean “lower pay, lower living standards, higher inflation, and higher mortgages,” as estimated by both the OBR and the Institute for Fiscal Studies (IFS). The IFS director, Paul Johnson, emphasized that, despite current efforts to increase revenue, Ms. Reeves may need to implement additional tax hikes in coming years if economic growth fails to meet projections.

The new Budget is also expected to impact the job market, with the OBR forecasting the potential loss of around 50,000 average-hour jobs due to the NIC increases. Economists warn of added inflation pressures from the spending initiatives, which could further strain household finances.

James Smith, research director at the Resolution Foundation, said, “Even if it doesn’t show up in pay packets from day one, it will eventually feed through to lower wages.”

Nonetheless, the International Monetary Fund (IMF) has endorsed some aspects of the Budget, praising the spending on public services and the sustainable tax measures. The IMF stated, “We support the envisaged reduction in the deficit over the medium term, including by sustainably raising revenue.”

Despite these assurances, the Budget’s measures have sparked debate over the long-term impacts on wages, inflation, and economic growth, with many workers concerned about their future financial stability. With GDP forecasted to see only a short-lived boost, both households and businesses remain uncertain about the broader economic landscape under Labour’s new fiscal strategy.